Push back the square (now that we need it)

The history of private practice and how we got to where we are today.

In this 3-part series, we’ll examine the history of private practice and discuss how Ease is developing an AI-first solution to help more physicians transition back to private practice.

Part 1: The Boom days

Private practice was once the default for millions of physicians, it was available on almost every street corner in America, and contributed to trillions of dollars in local economies.

According to the American Medical Association, private practices support over 12.6 million jobs, generate over $2.3 trillion in economic activity, and pay out over $1 trillion in wages and benefits.

At its peak, nearly 80% of physicians worked in an private practice setting, either as an owner, partner, or as an employee. In states like Texas, private practice once dominated the market as physicians often operated in large group practices or joined independent physician organizations to help negotiate better reimbursement rates, ancillary services, and other hospital or vendor operational costs that typically would be more expensive when working alone.

The reason private practice was booming because way back in the 1970s COGME created federal licensing exemptions to speed up foreign medical graduates’ ability to gain U.S. medical licensure. This resulted in hundreds of thousands of physicians from countries such as India immigrating to the United States to practice, and a number of them were known to open their own private practices upon finalization of their state and federal licensure requirements.

This steady increase in the physician supply was one of the reasons why private practices remained successful despite regulatory changes like HMO and payor consolidation that started way back in the 1960s. But an often-overlooked contributing factor to private practice maintaining it’s relevance over the years was the physician-to-physician practice turnover which fueled practice ownership making it a whole lot easier to maintain marketshare and legacy payor contracts.

Consolidation Begins

The path to practice ownership was rarely starting from scratch. As even back in its boom time financing was difficult for new graduates. So if a physician wanted to own a practice there was traditionally two ways to accomplish it.

Buy a practice from a physician who already owned a practice.

Work at a practice for a physician who was near retirement to eventually take over the practice.

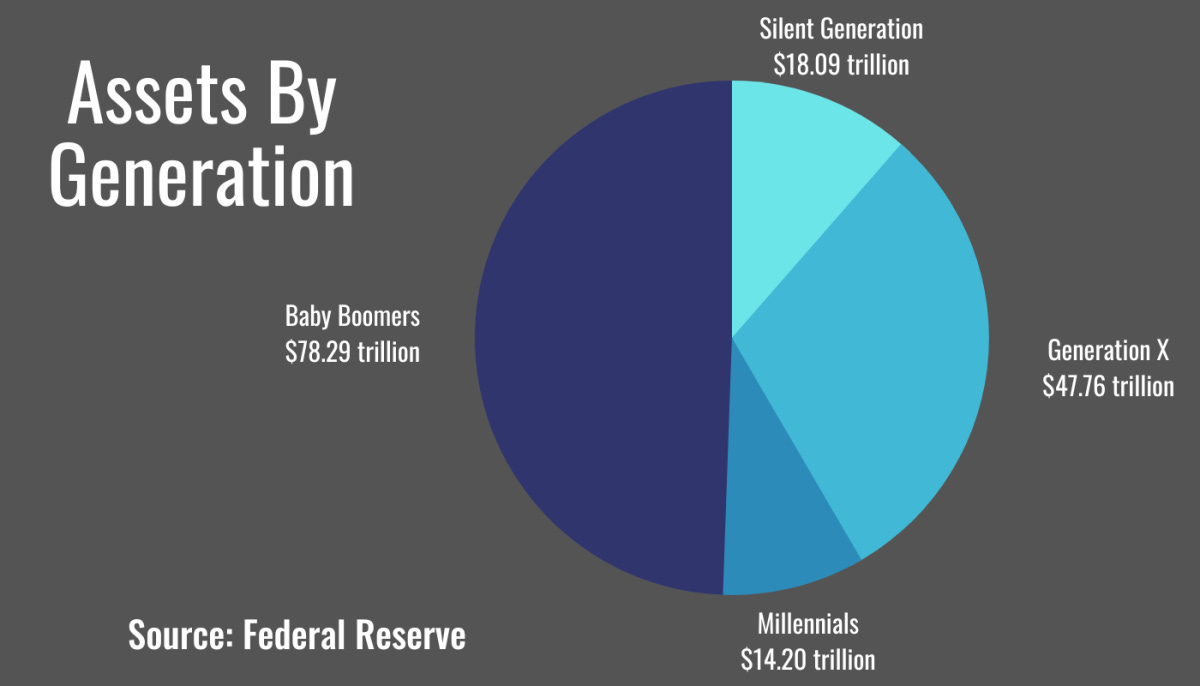

Now looking at all SMBs, the data shows that over 2.3 million cash-flowing small businesses are to be retired by baby boomers, creating one of the largest transfer of generation wealth in U.S, history, and 60% of them do not have any transition plans.

Transitioning businesses was the way of ownership for almost every small business in the U.S. and it remained that way for generations. That is until consolidation began and everything changed for physicians.

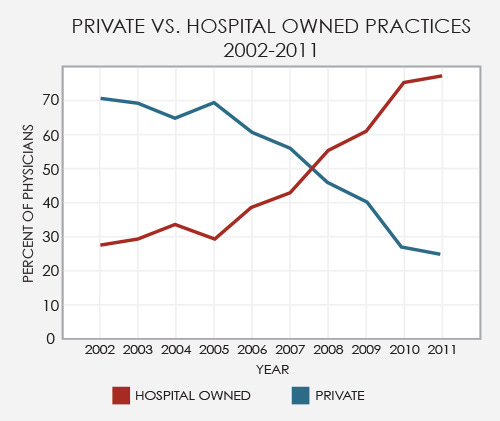

Two waves of consolidation took place, the first in the early 2000s when hospital systems expanded their market footprints due to new regulations and health plans that favored inpatient services over outpatient.

This was combined with new regulation that suspended the 1970s licensing programs for foreign medical graduates, now known as IMGs or international medical graduates. COGME, which manages federal policies, recommended allowing fewer IMGs to practice in the U.S. to better control the incoming supply and placed new restrictions to limit residency programs that traditionally accepted and trained IMGs. With less physicians entering the U.S. meant less physicians entering the private practice workforce, which halted the physician-to-physician practice system that had existed for 100s of years.

The new health plan was HMO, which was actually not so new, as it was initially created during the Nixon administration but had recently been amended to define the term "medical groups," which expanded the qualifiers with open enrollments, HIPAA (🤬), and allowed for more inpatient services shifting reimbursements from larger private practice medical groups or IPA’s to hospital corporate care systems.

This new health plan regulation also gave hospital systems the ability to control and manage outpatient physician admission privileges as these new health plans implemented new training requirements for (e.g. Required Board Certification) in order to bill for healthcare reimbursements. With fewer outpatient physicians caring for their patients during inpatient admissions, hospitalists became more prevalent.

The patient funnel was now fully under the control of hospitals.

Boomers sale to new buyers

It's known that new markets are created by three things:

New technology

New regulation

New user behavior

By limiting IMGs from gaining U.S. licensure, COGME set the stage for a market shift in buyers. With fewer physician buyers entering the workforce, combined with inpatient admission privileges gradually being stripped away. Hospitals began to capture market share from boomer practice owners, making it increasingly difficult for them to stay in business. That meant they were either forced to hold out and continue to get squeezed while waiting for a physician buyer or sell to "the system" and get out while they were ahead. So one by one, practices were acquired or merged with health systems across the country, and that consolidation process lasted for about a decade.

I initially wrote this for a post on LinkedIn but I felt like it was a perfect way to transition into part 2 while also providing more insight into why boomers sold.

Using residential real estate I'll explain why new doctors aren't starting new practices.

Most common home owners: Boomers and Gen X'rs

Least common home owners: Millennials and Gen Z

Most common practice owners: Boomers and Gen X'rs

Lease common practice owners: Millennials and Gen Z

Reason for disparity in home ownership:

- Increase debt to income ratios due to student loans

- Home price increase due to boomers selling to PE and investors

- Inflation with increasing interest rates

- Limited supply

Reasons for disparities in practice ownership:

- Increase in debt requiring immediate repayment upon completion of training

- Increase in debt limiting financing options for funding practice startup costs

- Boomers with practices selling to HCOs, PE, and investors

- Limited supply

Typical path to home ownership:

- Buying an existing home, not building from scratch

Typical path to practice ownership:

- Buying an existing practice, not building from scratch

Because less millennials are home owners does not mean less millennials want to be home owners. Most millennials would be home owners but can't afford to be home owners due to the increase price of homes + high interest rates.

Because less doctors are practice owners does not mean less doctors want to be practice owners. Most doctors would choose practice ownership but can't afford practice ownership due to student loans obligations. (based on historical physician behavior)

What this tells us is that this is more of an economic issue than a market issue behind the why physicians are not starting new private practices. However, in the same way that ZIRP increased the number of startups, AI will do the same for private practices. But one major difference between the two is that doctors are licensed and must abide by an oath to do no harm. Enhancing the viability of their businesses and making them safer bets that will have a much wider impact on society.

In Part 2, we'll discuss how physicians have been excluded from technology development for almost 20 years and how this has affected care delivery, access, and healthcare costs.

Join the conversation by sharing your thoughts on private practice's past and future.